Our Fees & The CCS

Session Times & Fees

At Small Friends, we’re open Monday to Friday, 7:45am – 5:00pm, for 50 weeks of the year, including school holidays! We offer both full day and short day sessions to suit your family’s needs.

We close on all public holidays and take a short break over Christmas, closing for 2 weeks to rest and reset for the year ahead.

Session Options

Full Day: 7:45am – 5:00pm @ $125

Morning Session: 8:00am – 12:00pm @ $68

Limited spots | Age conditions applyAfternoon Session: 1:00pm – 5:00pm @ $68

Limited spots | Age conditions apply

Short Session Transition Policy

We thoughtfully support our youngest Small Friends as they build confidence to transition into longer days and prepare for Kindy. Short sessions (morning or afternoon) are available with the following age-based guidelines:

2-Year-Olds

May attend up to 2 short sessions per week.

Planning more than 2 short sessions each week? We ask that one of those be a full day.

3-Year-Olds

Can begin with short sessions for a maximum of 4 weeks.

After the first 4 weeks, we’ll gently transition bookings to full day sessions.

4- & 5-Year-Olds

Short sessions are not available for this age group. All bookings must be full day sessions.

Fees

A $80 non-refundable administration fee is payable on acceptance of enrolment.

We do not charge for the 2 week Christmas break. All public holidays are chargeable.

Small Friends is approved for Child Care Subsidy (CCS) through Centrelink, making families eligible for fee assistance to help with the cost of care.

Fees must be paid via the Direct Debit Success payment system, of which you can have charge weekly or fortnightly and statements via the Xplor App will keep you updated and on track with your financial commitments.

Fees are charged one week in advance, so your first payment will cover both the enrolment fee and an additional week of care to keep your account one week ahead.

Claiming The CCS

To work out if you are eligible for the Child Care Subsidy you will need to complete an assessment using your online Centrelink account through myGov. If you’re thinking about enrolling your child at Small Friends, you should do this as soon as possible.

What you need to finalise your CCS assessment:

Combined family income

Activity level of parents

Type of child care service (Small Friends is Long Day Care).

Please be aware that assessments can take up to 28 days to be processed, and during that time you will be required to pay full fees. Once your assessment has been processed, and you are eligible, your payments will backdate to the date that Centrelink has approved.

Where to start

You need to ensure you have an active myGov account, once you have done this you’ll need to link Centrelink. The buttons above explain how to work through the myGov account process.

Completing your assessment

When you sign into myGov, follow the link to Centrelink and you’ll see a notification that you have an outstanding task Child Care Subsidy Assessment. This is how Centrelink confirms your current situation and calculates any benefits you may be entitled to.

How is income calculated? What happens if it changes during a financial year?

Your CCS percentage will be based on your estimated combined annual family income. Your actual subsidy entitlement will be worked out at end of year reconciliation when your actual adjusted taxable income is known (after you have lodged your tax return).

The easiest way to estimate your income is to base it on your previous year's tax return as well as any expected pay rises. Parents nominate a bank account to receive any lump sum payments. You should put current salary in, if this is what you estimate your salary will be for the whole year. Don't forget to include your partner's salary, if you have one, as it is calculated based on combined annual family income.

Because some families are unable to estimate their income accurately, 5% of your weekly CCS entitlement will be withheld. Following reconciliation, if you haven't received enough CCSS based on your adjusted taxable income you will receive a lump sum payment; if you have been paid too much CCS, you will have a debt to repay.

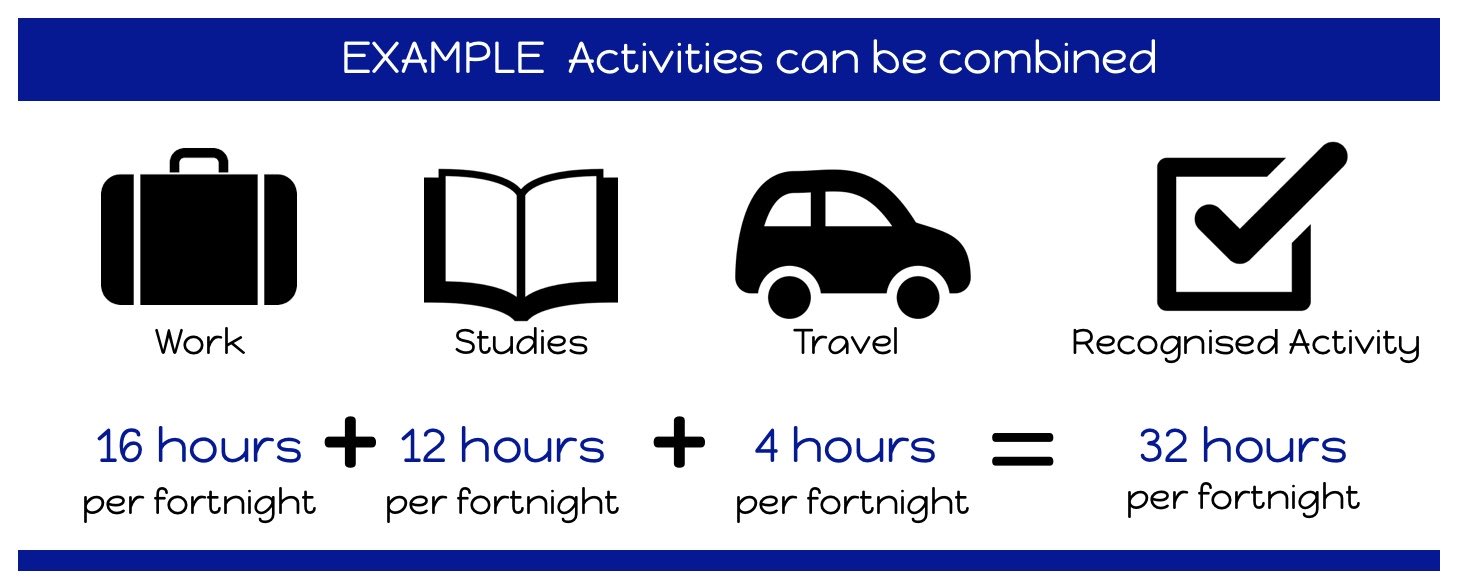

Activity Test

There is a three step activity test. The activity test is determined at the family level. Two Parent Family - both parents must meet the activity test and the person with the lower number of hours will determine the relevant step of the activity test. Sole Parent Family - the sole parent must meet the activity test.

What is an activity? There are a range of activities that meet the activity test.

paid work (including leave)

study and training

unpaid work in a family business

looking for work

volunteering e.g. assisting with educational programs within your child’s school.

self-employment

and other activities on a case by case basis.

You can also include reasonable travel time to and from your place of activity to Small Friends.

How do I prove how many hours I Work, Study Or Volunteer?

Parents self-declare their activity to the Department of Human Services (DHS) and no evidence is required at the time you self-declare. This is generally done just prior to a new financial year, when you provide your income estimate for the coming financial year.

DHS might ask some parents to provide evidence as part of their normal random spot checks. Evidence could include, for example, a copy of a pay slip or a letter from the organisation where you volunteer.

Parents can change or update their activity test details whenever they need to. This will be done via your myGov account, which can either be done via their webpage log on or the related app on your smartphone.

What if I work irregular work hours?

If you work irregular hours you can estimate the number of hours you work per fortnight over a three-month period. You can include a reasonable amount of time to travel to and from Small Friends to your place of activity, if you need to.

Your estimate should be for the highest number of hours you might require, even if you don't require those hours every day. This gives you the flexibility to pick up additional hours of work and know that care will be available.

If your irregular hours change that's okay as you can update them whenever you need to via your myGov account.

Is looking for work considered an activity?

Actively looking for work is a recognised activity. If it's the only activity you do, you will meet the first step of the activity test (36 hours of subsidised child care per child, per fortnight). You can combine actively looking for work with another recognised activity such as an approved study course to receive further hours of subsidised child care.

Calculating study hours to meet the activity test

When calculating study hours (part-time or full-time), include course contact hours, study outside course contact hours, and breaks such as term breaks. You will need to undertake at least eight hours of study per fortnight to be entitled to 36 hours of subsidised child care per child, per fortnight.

My activity levels will change regularly. How do I update this information?

You can change or update your activity test details whenever you need to. You will do this via your myGov account, including via an app on your smartphone. Updating your details whenever they change will help you avoid getting a debt.

Does Parenting Payment Partnered affect my activity level?

If you are on Parenting Payment Partnered, and the only activity you undertake is meeting your mutual obligation requirements under that payment, then your entitlement will be 36 hours per fortnight.

You can also combine your mutual obligation activities with other activities, such as volunteering, to be entitled to more hours of subsidised care. If you have an exemption from mutual obligation requirements, then you will be entitled to 100 hours per fortnight.

Do I need to do additional activity if I am on Carer Payment or Carer Allowance?

If you are on Carer Payment your activity test result will be 100 hours per fortnight.

If you are providing constant care for someone but don't qualify for Carer Payment, because of the income or assets test requirement, your activity test result will also be 100 hours per fortnight.

As a Carer Allowance recipient you will meet the activity test and have an automatic entitlement to 72 hours per fortnight. This can be increased to 100 hours per fortnight if combined with another recognised activity. If you have a partner, they will also need to meet the activity test, and the hours of subsidised care per fortnight you will be entitled to as a family will be based on whichever of you has the lower activity level.

Do Grandparents with a disability need to meet the Activity Test?

Grandparents who are the primary carers for their grandchildren are exempt from the activity test.

Is Parental Leave considered an activity?

If you undertake paid work, and paid or unpaid parental leave is a condition of your employment (as an employee or contractor), then this is considered to be part of your paid work. The hours of activity will be the same as what they were immediately prior to you commencing parental leave but it needs to be at least eight hours per fortnight. So, if you were working part-time or full time, then you are still considered to be a part-time or full-time employee while you are on parental leave.

Is looking after my own children considered an activity?

Looking after your own children at home does not count as an activity.

Does being on sickness benefit impact on the Activity Test?

Depending on what type of sickness benefit you receive, this may qualify as meeting the activity test.

Is travel time considered activity?

You can include a reasonable amount of travel time to and from the child care service to your place of work, study or other recognised activity.

I'm a Teacher. Does the work I do at home count towards my activity hours?

If you are a teacher, school holidays count as they are part of your conditions of employment. Planning lessons at home would be considered to be part of your normal requirements and wouldn't count as extra activity hours.

Is working in a family business a recognised activity?

Yes. Working in a family business owned by a member of your immediate family such as your partner, your parent or your parent's partner, a sibling, one of your adult children or their partner, or another person as determined by the Department of Human Services, is a recognised activity.

What is approved study?

An approved course of study means a secondary or tertiary course. The study activity requirements will include:

a higher level than you’ve completed in the last 10 years

the same level as a course you’ve previously started in the last 10 years if you didn’t complete it.

Is being self-employed a recognised activity?

Being self-employed is a recognised activity, as is setting up a business (for a maximum of six months).

Is volunteering a recognised activity?

Yes. The definition of voluntary work is activities which could be expected to improve your work skills or employment prospects (or both); voluntary work for a charitable, welfare or community organisation; or voluntary work for a school, preschool or centre based day care service, if the work directly supports the learning and development of the children at the school, preschool or service. For example, participating in a reading program would be a recognised activity, but being on the Parents and Citizens Committee, or working in the school canteen, are considered parental duties and would not be considered a recognised activity.

If volunteering is your only activity you will be eligible for the first step of the activity test (36 hours of subsidised care per fortnight).

Is coaching my child's football team considered a volunteer activity?

As coaching is undertaking a parental role, it is not considered as a volunteer activity.

Will full-time Grandparent Carers be entitled to access subsidised child care?

Being the principal carer of your grandchildren means that you look after them for at least 65 per cent of the time and you have substantial autonomy for the day-to-day decisions about the child's care, welfare and development.

Grandparents on income support, who are the principal carers for their grandchildren, will have access to subsidised care through Additional Child Care Subsidy (Grandparents).

The subsidy will be equal to 100 per cent of the actual fee charged up to 120 per cent of the relevant hourly rate cap, for up to 100 hours of subsidised care per fortnight.

Grandparents who are the principal carer and who are not on income support will be exempt from the activity test (and able to access up to 100 hours of subsidised care per fortnight). However, their subsidy percentage will be determined by their income.

Additional Child Care Subsidy (Transition To Work)

ACCS supports families who are transitioning to work from income support.

Transition to work means transitioning from an income support payment to work by engaging in work, study or training activities and it will cover 95% of your actual fees.

Families who are transitioning from income support to work by engaging in work, study or training activities and have a Job Plan in effect, will be supported by ACCS.

ACCS Families And Grandparent CCS Families in these circumstances may be able to access the Additional Child Care Subsidy. Subject to individual circumstances.

Please tap here for more ACCS information.

Why is 5% of the subsidy withheld?

Because some families are unable to estimate their income accurately, 5% of your weekly CCS entitlement will be withheld. Following reconciliation, if you haven't received enough CCS based on your adjusted taxable income, you will receive a lump sum payment. If you have been paid too much CCS, you will have a debt to repay.